Plan for the day

Daily Plan

Heading into the day, there are lots of opportunities into the open. But we are gapping up on so many names, I want to be careful not to chase. Would look for an opening drive on TSLA, AMD, AAPL, but want to see it retest a level. Also watching SOFI and MU but less knowledgeable about the ticker. I am focusing on not taking partials today. Playing 2:1’s with Stop to BE at 1:1. If the setup is still there I can still enter. Stay patient and don’t go on tilt.

Trade Reviews

NVDA - 5m Opening Range BnR

Trade Thesis: NVDA was showing relative weakness at the open. AMD was also selling off on news and NVDA could have been seen as a sympathy play.

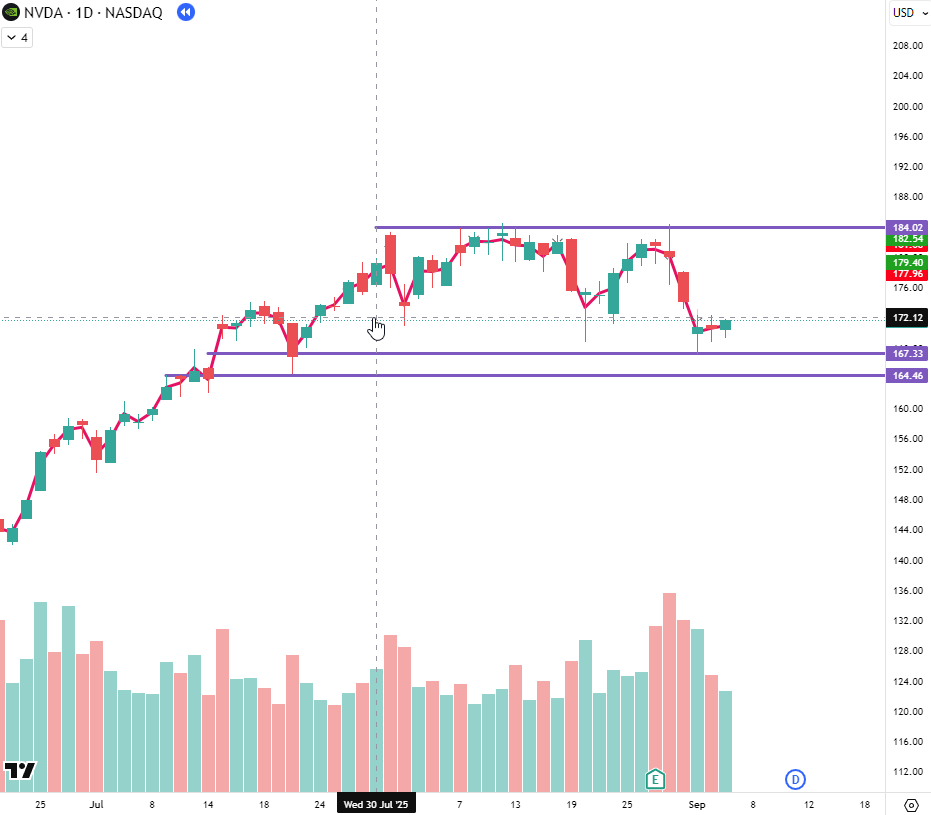

Context(1Day): Priced was had sold off on elevated volume and had not managed to bounce. Wednessday’s low was established as a key level. NVDA was not actually on my top watch heading into the open. Most of the tickers I was looking other than AMD were to the longside

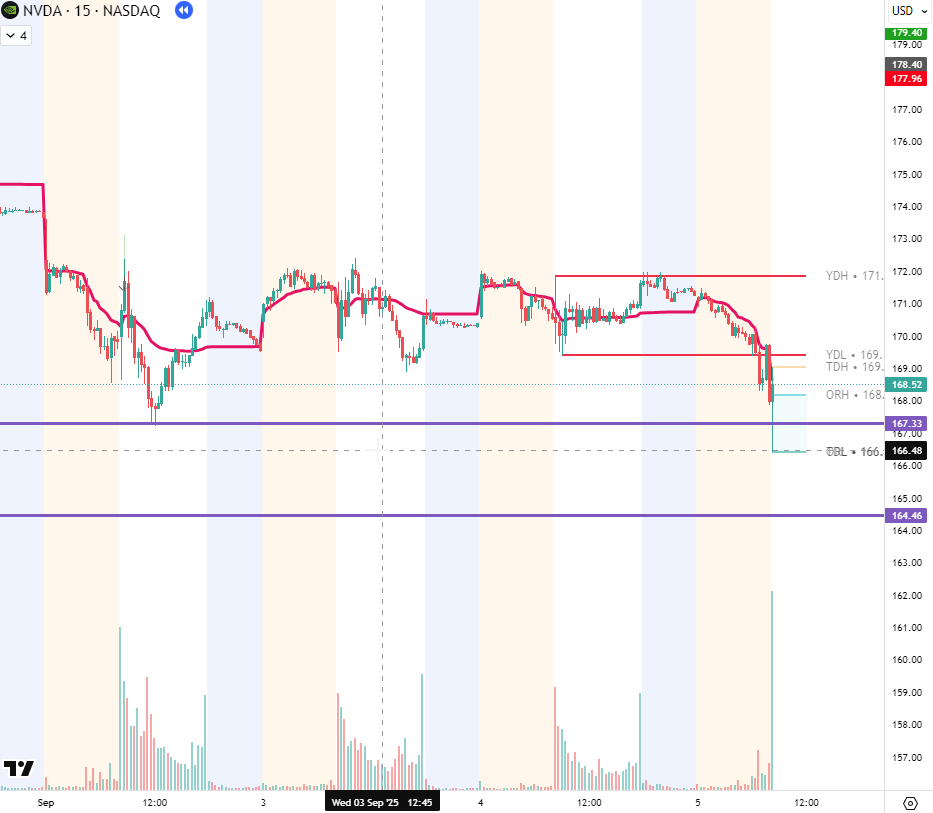

Context(15 min): The 15 minutes was very much in range. But as we opened we started trading under yesterdays low and also cleared the 167.33 level which was Wednesdays low.

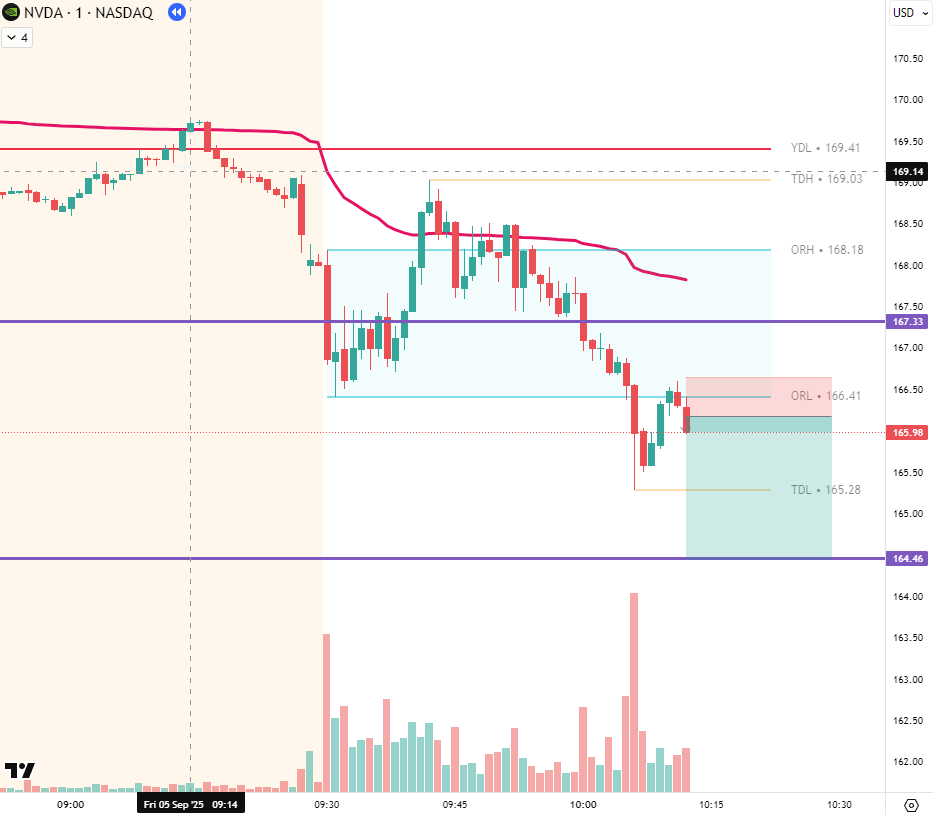

Execution(1 min): There were multiple confluences that make this a good setup. We were below PDL, VWAP and the 167 level. There was a nice retest of the 5 min ORB. Looking to take partials at LOD and the 164.45 key level.

Recap95min): Price bounced off the level nicely and chopped around for the rest of the session. This trade was well executed and properly managed.

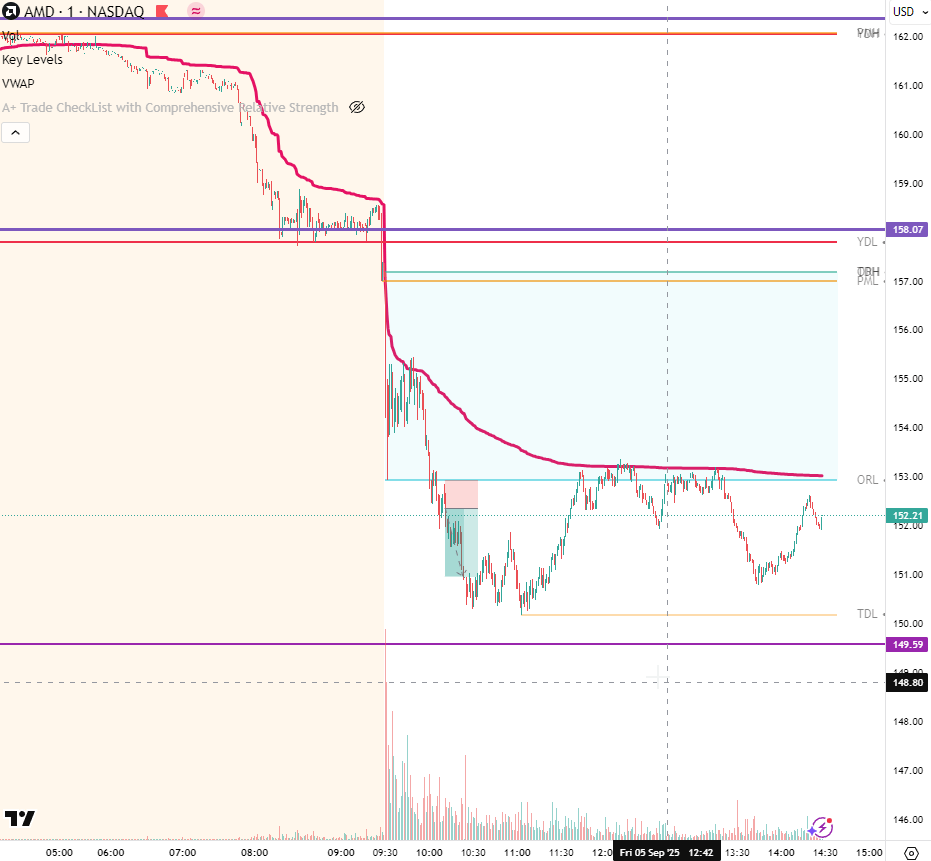

AMD - 5m Opening Range BnR

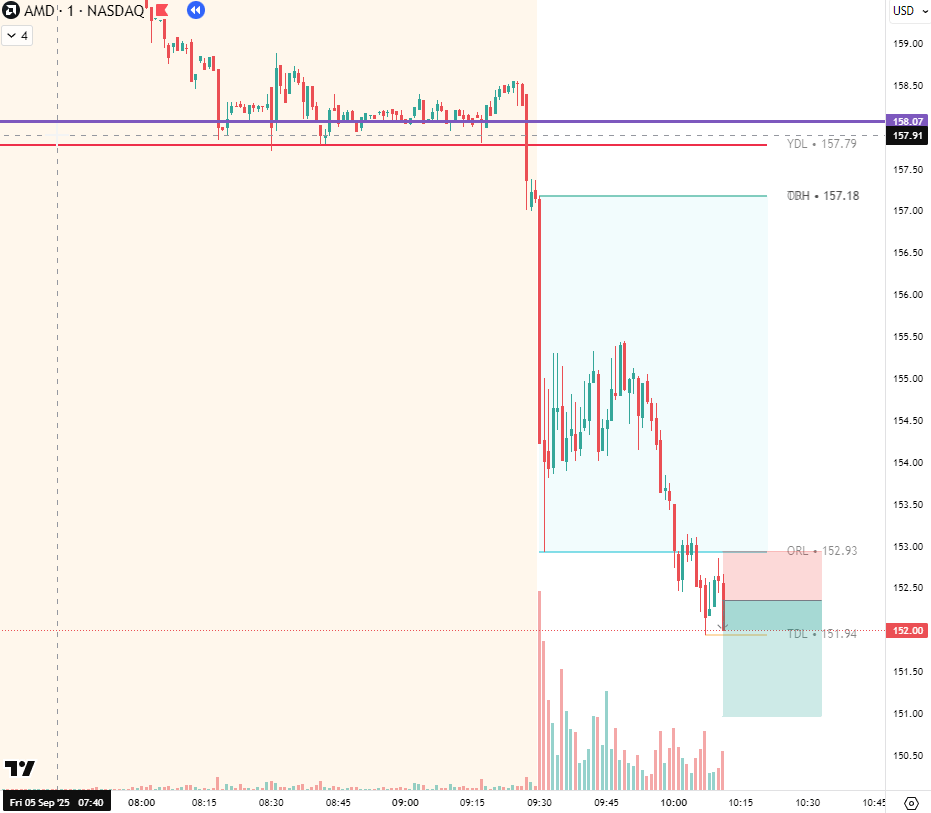

Trade Thesis: AMD was gapping down while the market was strong. It had been showing little momentum off the 158 level and once it received news that it was down graded it started selling off and opened below the level

Context(1 day): AMD continued to hover around the 158 level with each reaction off it getting smaller and smaller.

Context(15 min): Price was selling off in the premarket and was showing no signs of slowing down.

Execution(1min): Not the cleanest entry, but there were quite a few higher timeframe confluences that lined up. So too the trade on the second, rejection which was essentially the lower high off the 5 min orb.

Similar price action to a lot of the market after it printed the low around 11. Will continue to track it as price continues to look bearish.

Daily Watchlist With Recap

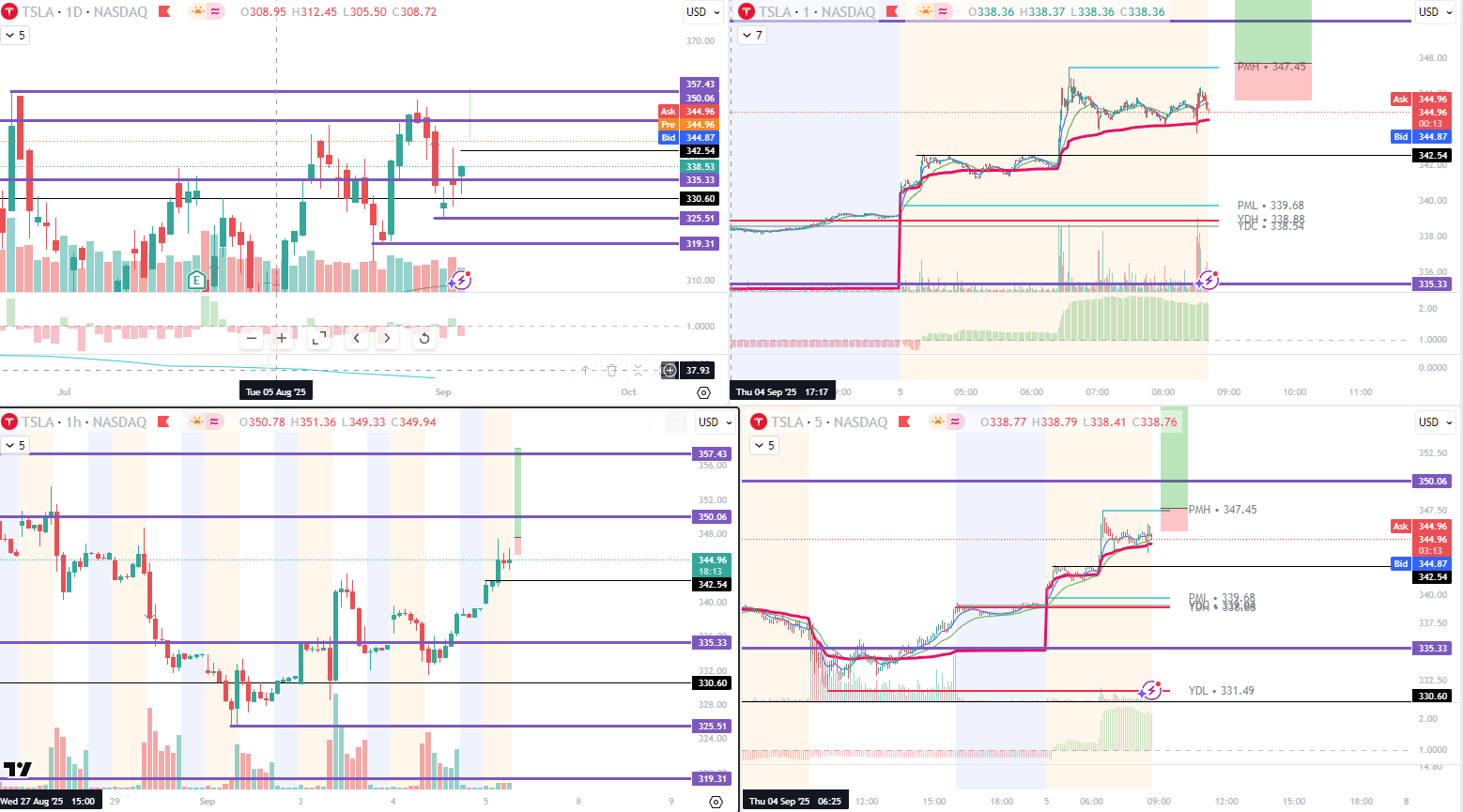

Ticker: TSLA

What I am watching: We are continuing to get the HTF direction right on TSLA, but have trouble being part of the move. Same thesis as we have had the last couple of days. Look for a move back up to 355ish. It looks strong, but dont really like the gap on the daily too much, so being a little not to chase too early.

Post Session Chart

It played out perfectly, but I did not take the trade. I was reluctant because I thought the SPY/QQQ were going to sell off. Lesson here, to not but too much weight on that especially with such a bullish stock so close to the open.

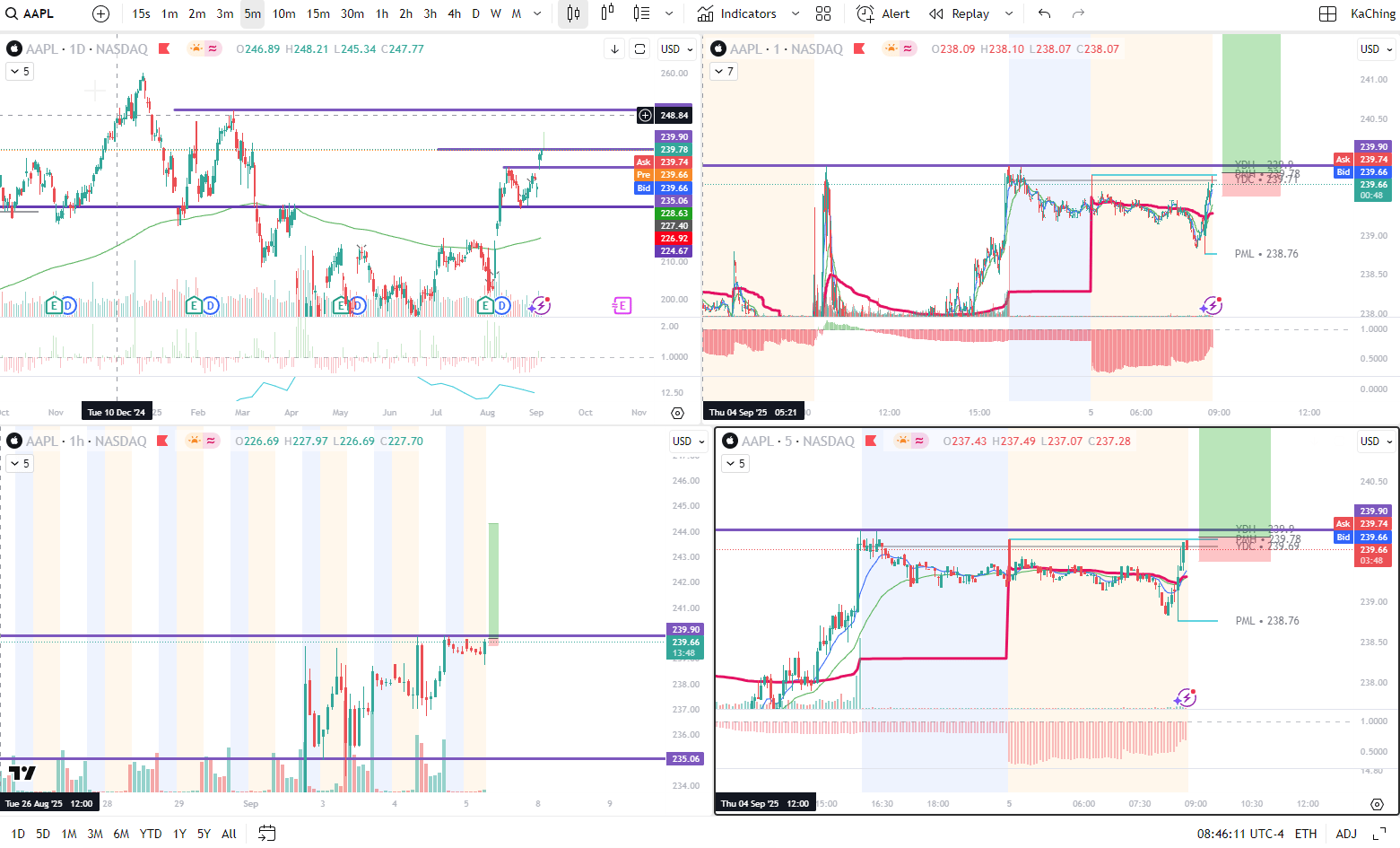

Ticker: AAPL

What I am watching: Nice move into the close yesterday and hovering at the top of the multiday consolidation range. Watching for a break of PDH/PMH/PDC for a move higher. This is a good setup as there are lots of confluences. Would also look to take this as an opening drive if we can get momentum off the open.

Post Session Chart

It was showing momentum but rolled over like most of the market when SPY/QQQ started heading to the downside.

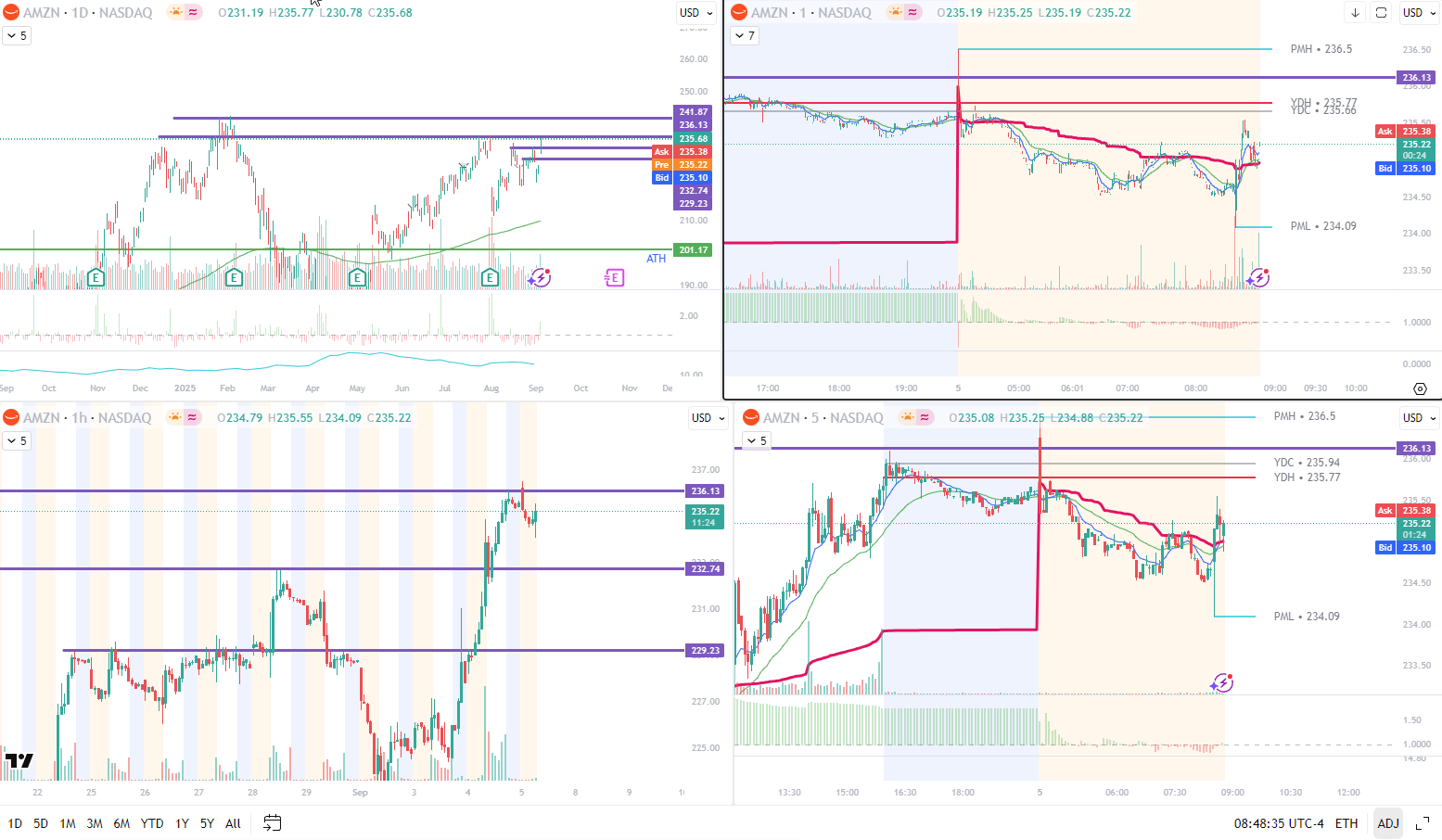

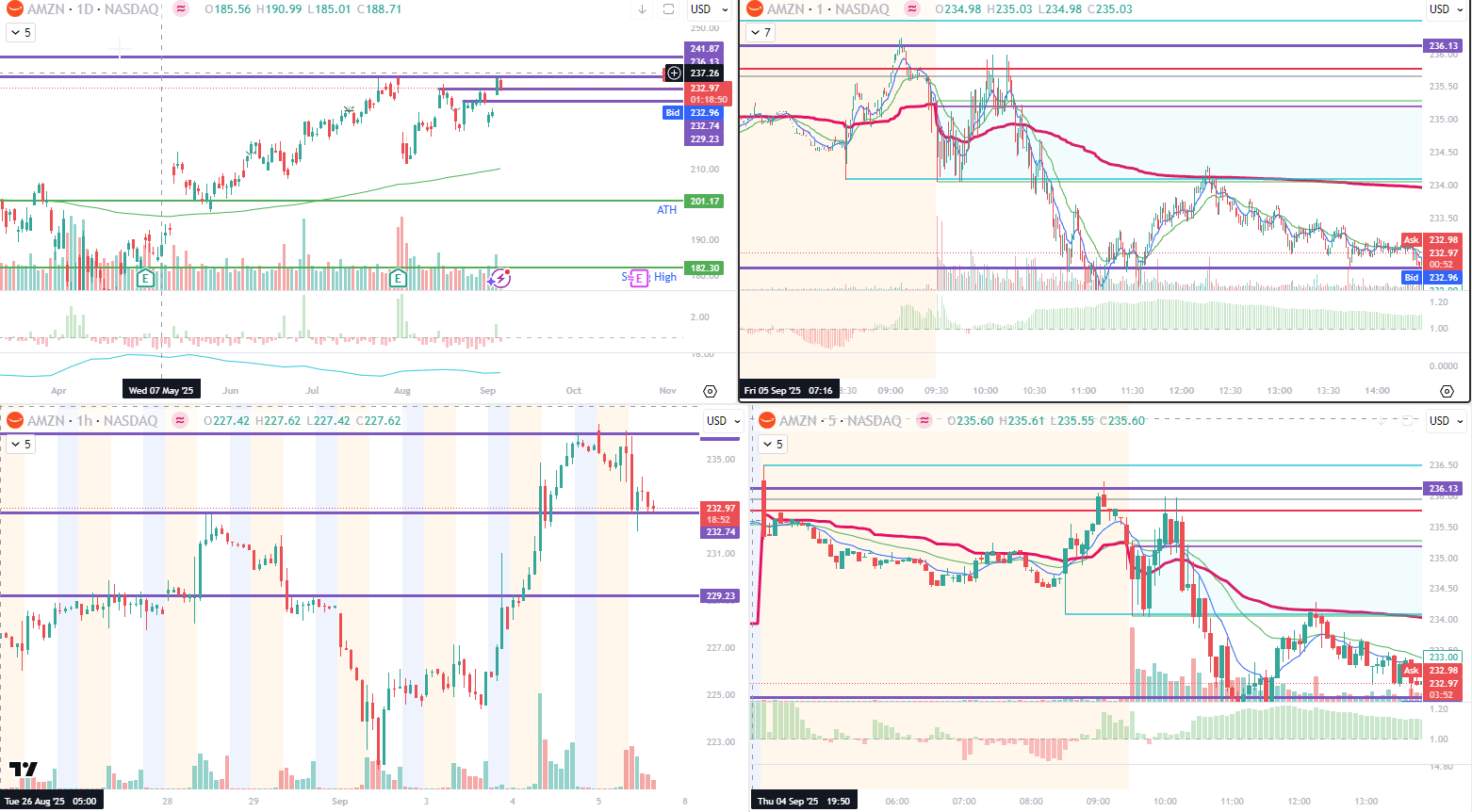

Ticker: AMZ

What I am watching: Big move yesterday, we are holding up. Watching the PMH for a move higher. This setup is good, a little less inclined to take it unless there is a a nice retest. There does not seem to be any major news catalysts on this one, but is setting up for an ATH play.

Post Session Chart

Never really showed momentum. Was looking to see if it could present a second day push, but likely because it seems the move was not news driven it failed to maintain.

Ticker: AMD

What I am watching: We are back at 158 and we have a news catalyst. If the market sells off early in the session, AMD, is a price candidate. Watching 158 for a move back down to 149.

Post Session Chart

Price broke 158 and got close to the HTF 149.50 target, but pulled up short.

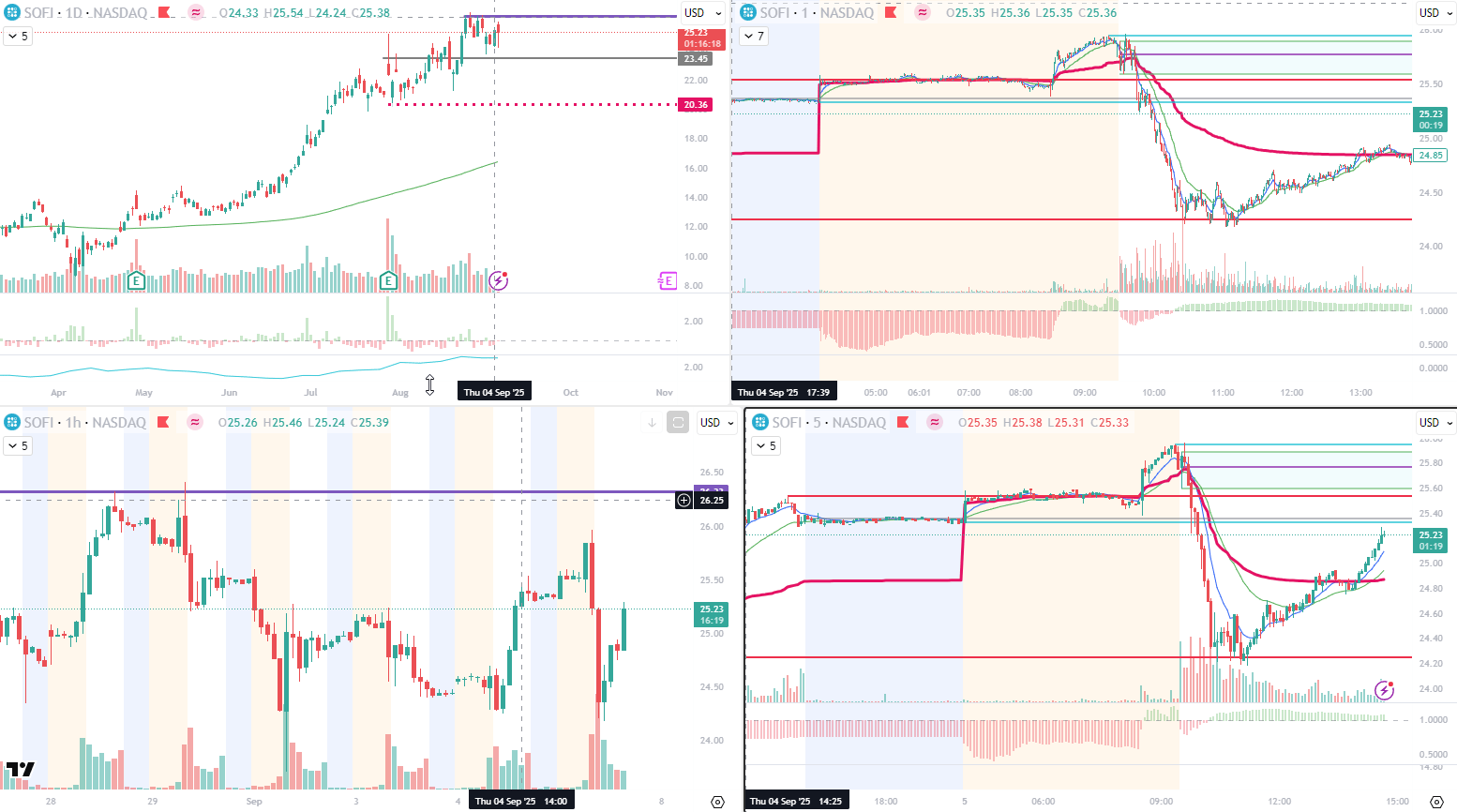

Ticker: SOFI

What I am watching: Another ATH setting up. Looks good for a moveup to 26.33. Watching PMH or even a ppossible PB to PDH at 25.54

Post Session Chart

Lost momentum and is now back in range.

Ticker: MU

What I am watching: News that MU met with Trump. BS news, but news non the less. Watching for either a break above PMH and retest of VWAP/126 for a move higher. Elevated RVOL.

Post Session Chart

Remained relatively strong, but the market rolled over so any bullish plays were off the table.

Review

Daily Review

Not a bad day. I missed the TSLA trade which I think messed up with my head a little and I took a TSLA trade I should not have.

I think overall though The setups where good and I managed to handle the shift in overall market direction well.