The Daily

Daily Plan

Its Monday with no major news catalysts over the weekend that caused any major market shifts. We are opening up in the middle of Fridays selloff, but gapping up slightly. We also have no major news today.

The primary plan is to stay patient. I can get a little trigger happy on Mondays as I am excited to trade after the weekend, but make sure the right setup presents itself, and if it does not than that is okay. Wait another day.

Top watches are TSLA holding above its previous day levels around 355. Also looking at GOOGL and AVGO to the upside.

NCDA looks weak if the market rolls over.

HOOD, APP are also gapping up a significant amount due to news.

REVIEW Of The Day

I need to get better at waiting for price to get the the level and then trust the level. Play the levels. This will keep me more attached the tre trade. I tend to get in early and therefore when price get to the level I tend to stop out at BE, or I don’t trust what is happening since I don’t know if buyers or sellers are going to defend the level.

Work on this tomorrow.

Missed Trade of The Day

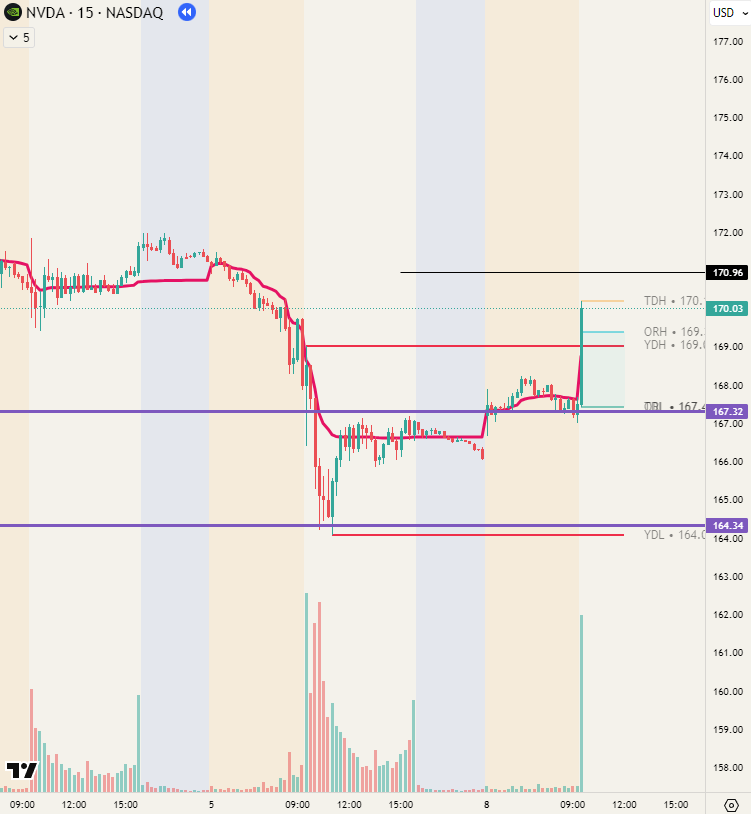

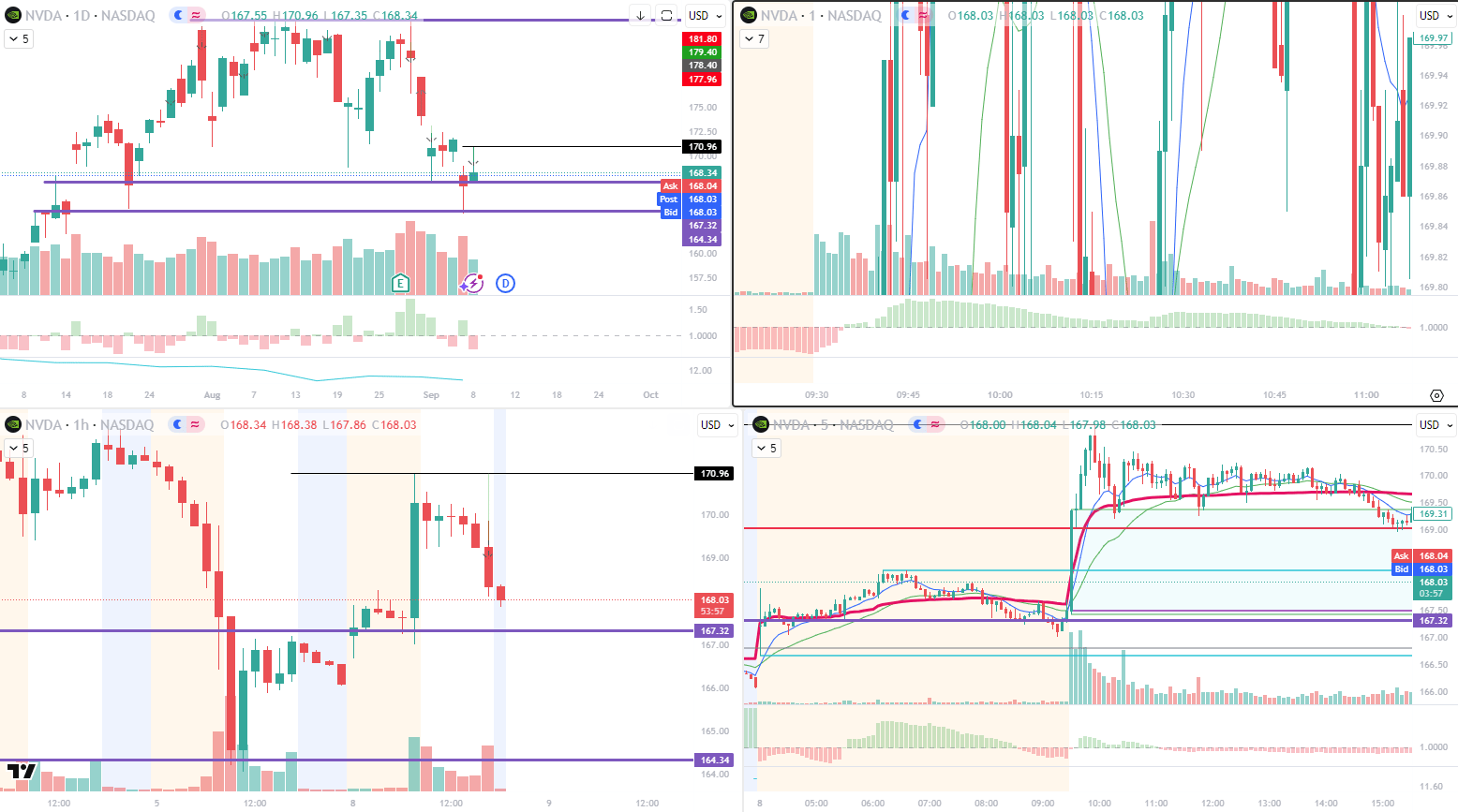

NVDA - PDH BnR

Trade Thesis: Break and retest of PDH

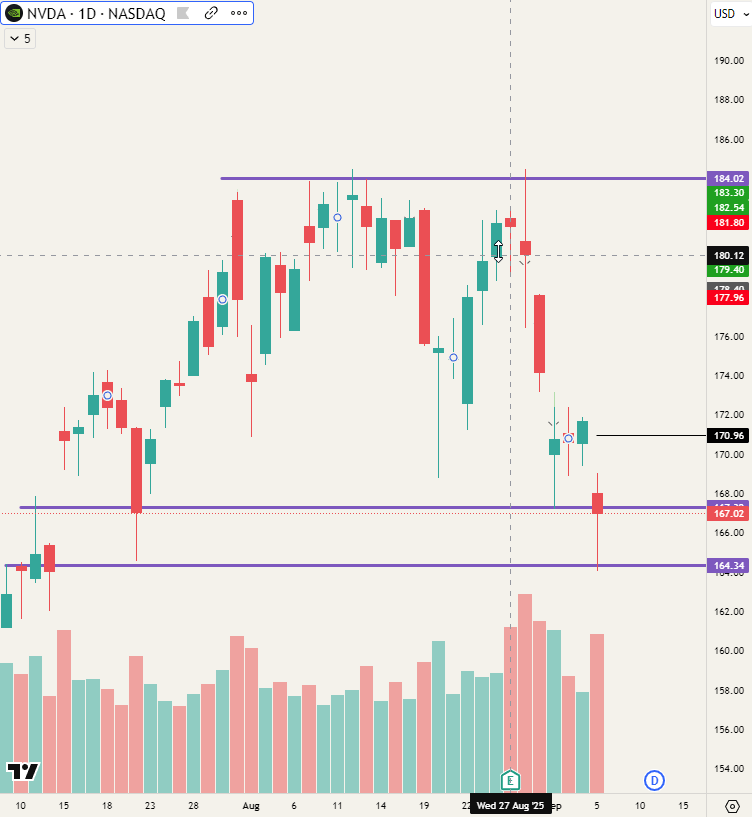

Context(1 day): NVDA had put in a nice hammer candle on the daily on Friday. rejecting the 164 level

Context(15 min): Price rejected the 167.32 level at the open and moved above PDH.

Execution(1min): Clean retest of the PDH. Not a deep retracement but a nice trading opportunity. I had NVDA incorrectly labelled as a short today, but should have switched the bias once it moved away from 167.32s

How it played out(5min): Price lost momentum and has chopped around as the session has gon on.

Daily Watchlist With Recap

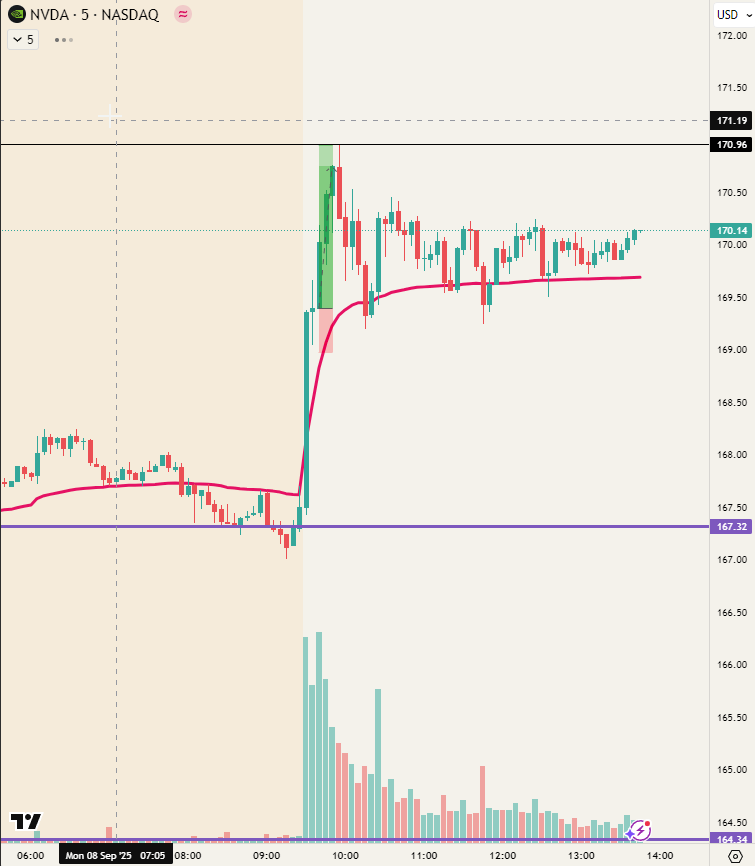

Ticker: SPY

What I am watching: Slight gap up, but operating inside yesterdays range. Will be patient at market open to get an understanding of where price wants to go. We are still very much bullish having put in an ATH Friday, before selling off early in the session.

Post Session Chart

Pretty rangy day. Intial push to the upside, then back down to LOD. Finished in the middle.

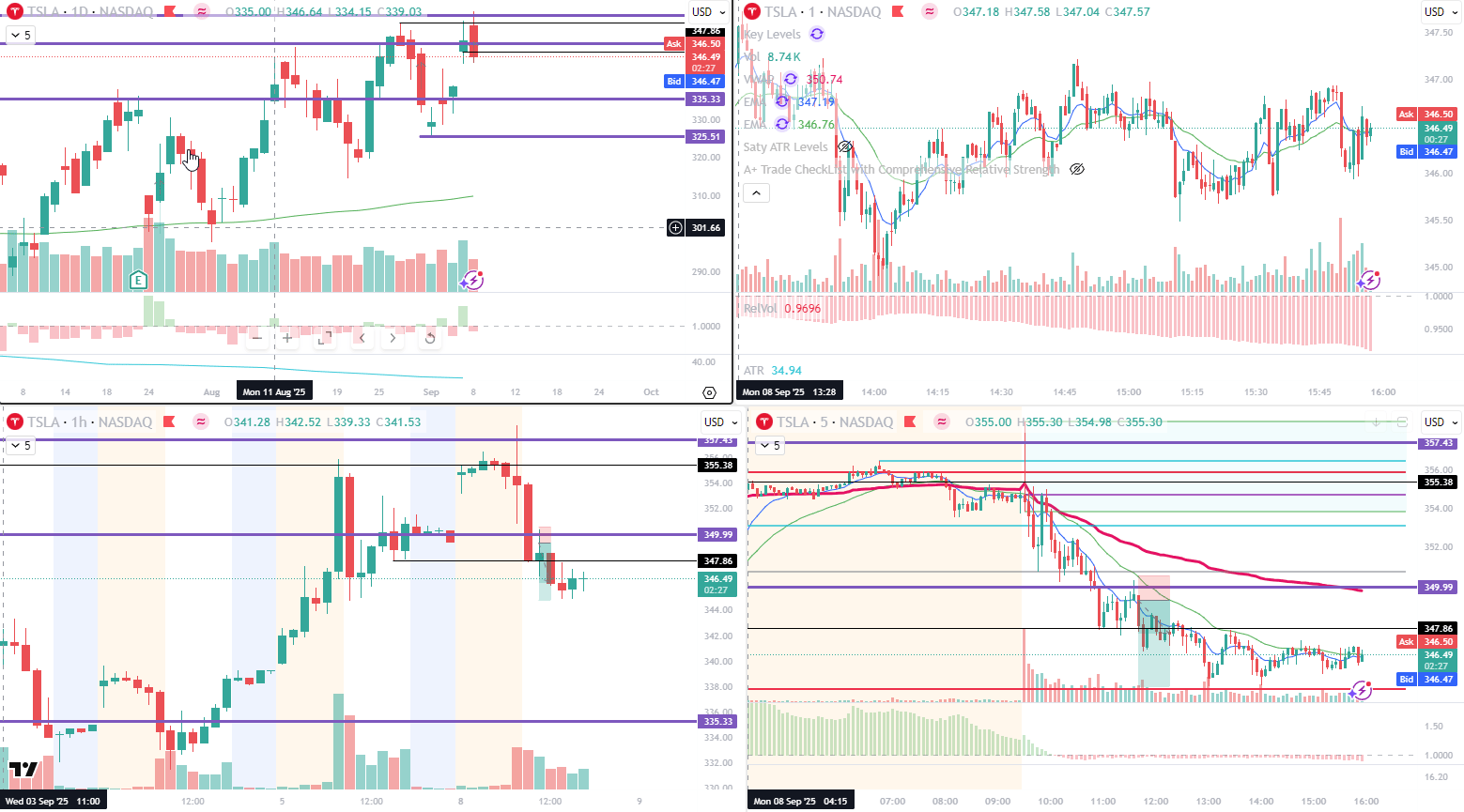

Ticker: TSLA

What I am watching: I am liking TSLA above PDH/PMH. Seeing if it can get above the 255.87/356.44 level, but also watching the resistance above at 357.43. Would ideally only like to take the trade at those levels if the HFT level has not been hit. If it does hit, look to retest the 357.44 level.

Post Session Chart

Move was to the downside. especially after it broke 350. I was able to identify this, but too a trade off a level that was a little lower and when it got back to 350 I got stopped out. Need to work on making sure the level touches. If it does not, don’t take the trade.

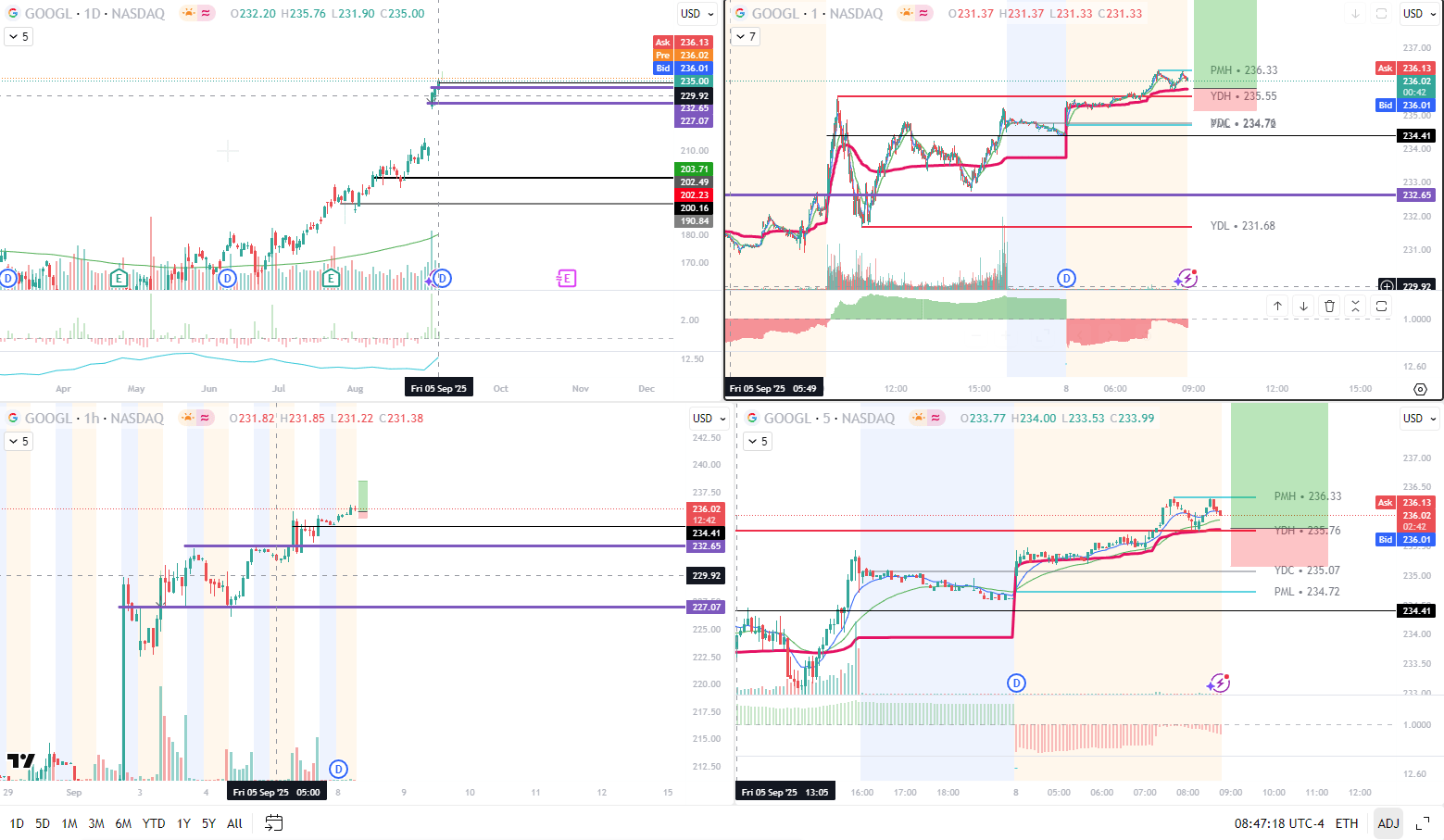

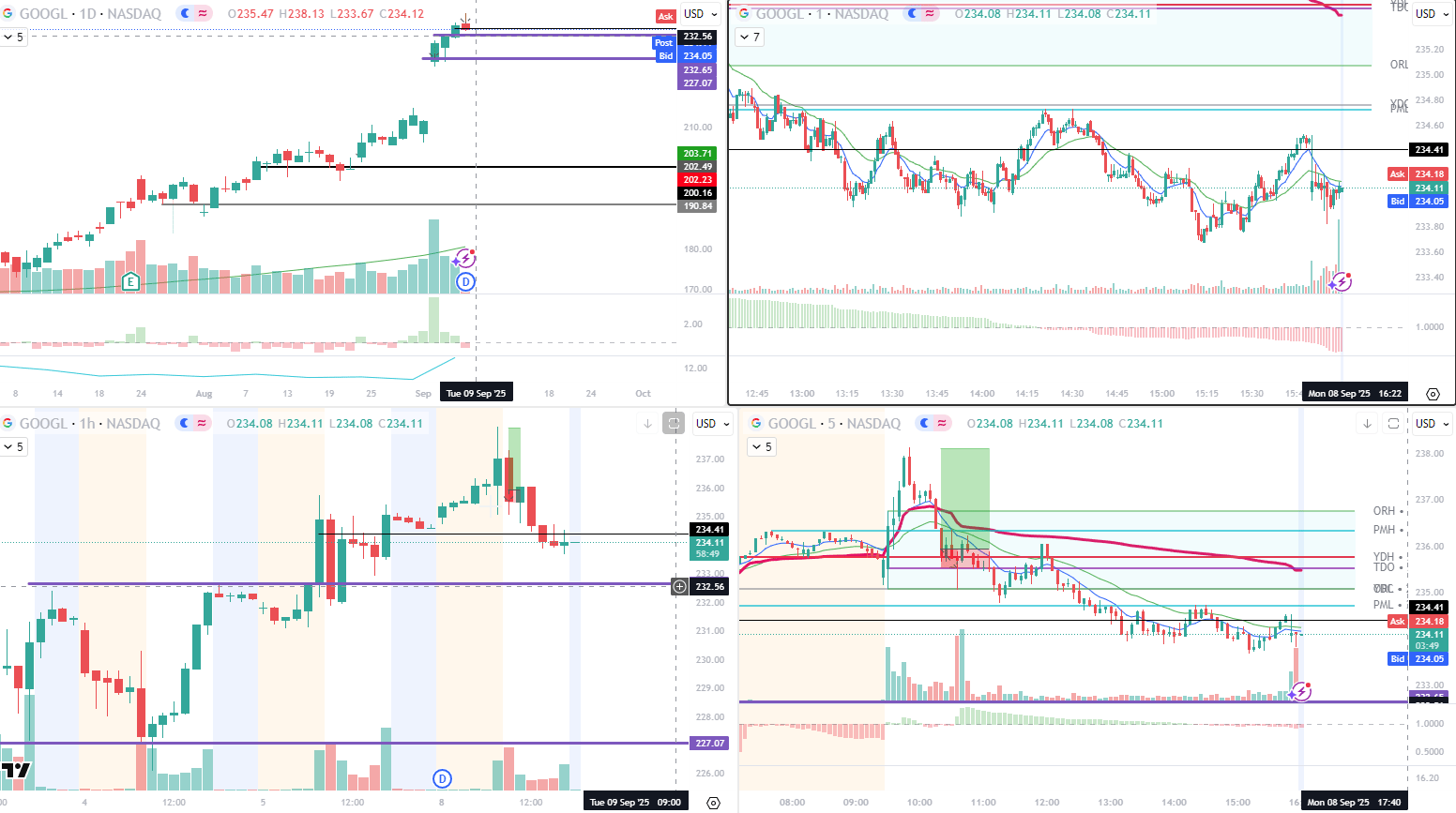

Ticker: GOOGL

What I am watching: Continues to look very strong. It is getting overextended, but also continuing to print green candles. We are trading above the PDH. So watch PDH levels as well as PMH levels for retests back into these price levels.

Post Session Chart

Initial drive, then it rolled over. Took a trade early off the 5min ORB breakout, that would have been a good trade, but got stopped out for BE.

Ticker: HOOD

What I am watching: HOOD is up on volume as a news catalyst of its inclusion in the SPY. Watch PMH for a retest. Quite a few levels above, so make sure you are focusing on the retest and watching if the levels above get tested.

Post Session Chart

Had momentum all day, but tough to get invovled.

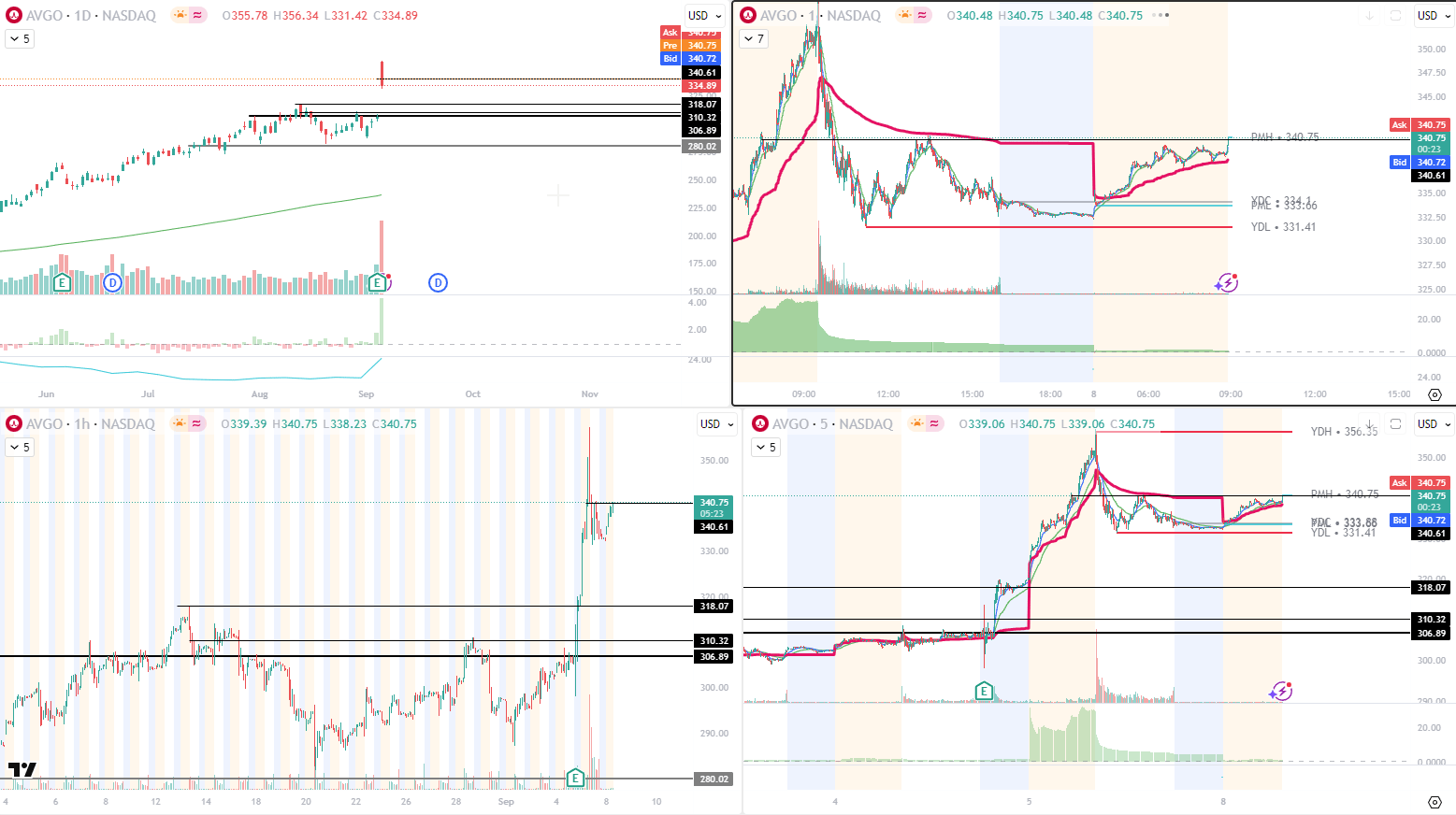

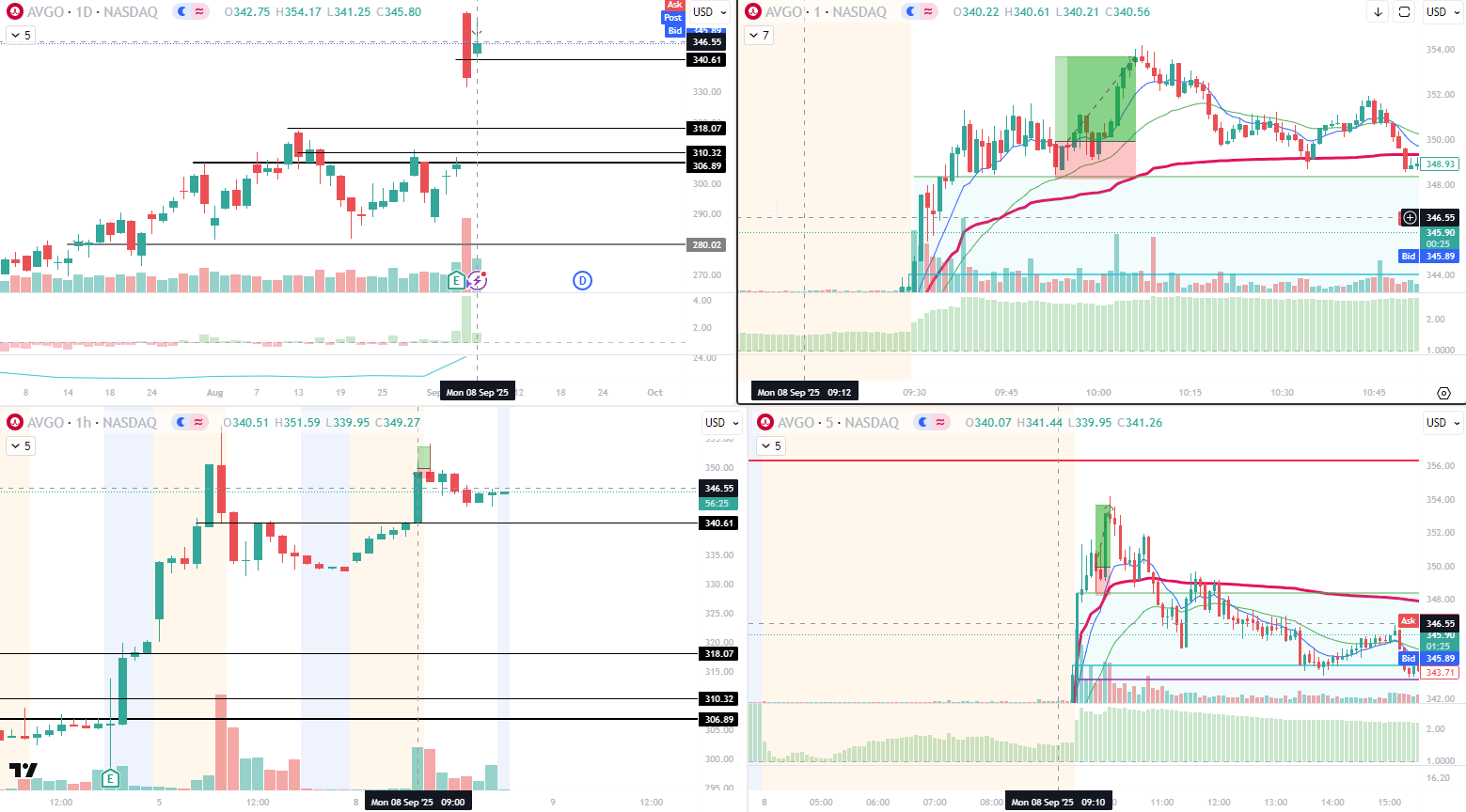

Ticker: AVGO

What I am watching: Lots of bullish momentum. Watching this as a continuation play, but also interested if the market rolls over and we get below PDL. We are quite far away from PDH, so I think it wants to act more as a target rather than an entry for the

Post Session Chart

I was in a trade above the 5 ORB, but got out for a BE as it was too choppy. Again another case of being too trigger happy. I need to learn to play the stops at the levels. This is a constant recurring theme in my trading

Ticker: NVDA

What I am watching: If the market struggles in the morning, will be watching NVDA. Might be a little too early today, but has lots of room below 164. Be cautious though, as this might need to setup tomorrow.

Post Session Chart

Was looking for the downside move, but should have been looking for the long. There was an nice hammer candle put in on the daily and price was gapping up.

Ticker:

<4 panel image>

What I am watching:

Post Session Chart

<4 panel image>

Review

Daily Review

<review of day>