Trade Reviews

AMD - 5m Opening Range BnR

Trade Thesis: AMD was gapping down in the premarket was below PDL and also had a level of support that needed to hold. Was watching the HTF level for a breakdown for a possible multi day short to the downside.

Context(1day): After a hammer on Monday, we followed up with a shooting start rejection yesterday.

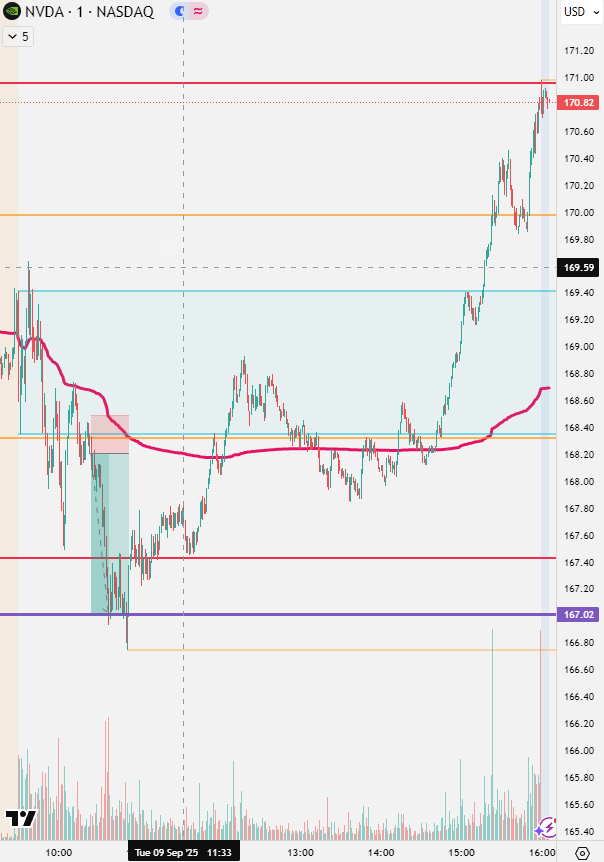

Context(15min): Did not have NVDA on watch coming into the open as price was fairly neutral and opening up in the middle of the range.

1 min(Execution): 5 min ORB retest. Was also forming a head and shoulders and price was failing to move higher after it rejected the VWAP.

Price hit the level perfectly and rebounded with the market. Good trade.

Missed Trade of The Day

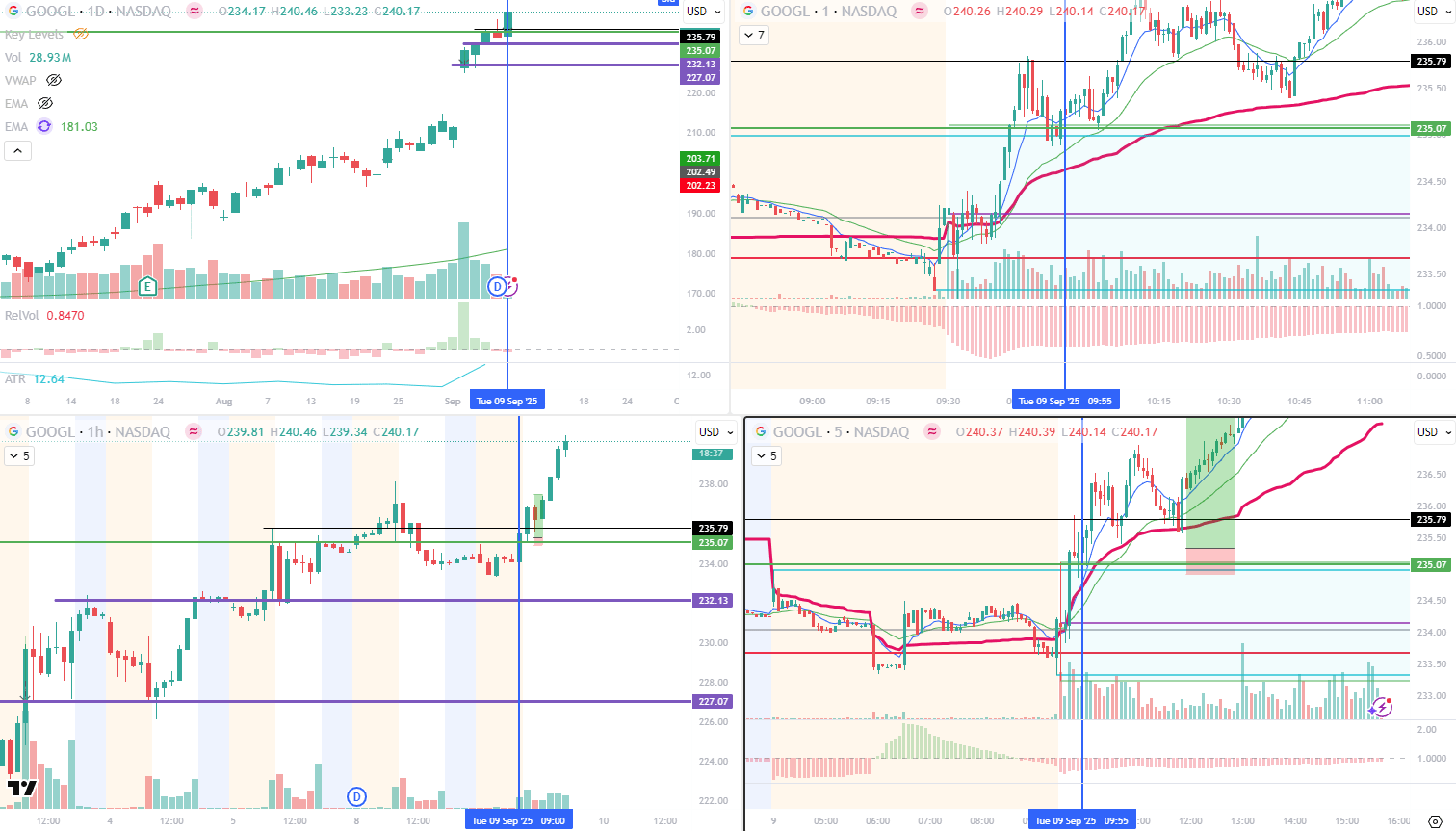

GOOGL - PMH BnR

Trade Thesis: Momentum stock that continue to trends.

Context(1day): Google is at ATH and is on rip since it settled its lawsuit last week. Red day yesterday but watching to see if it could continue its momentum.

Context(15min): Price remained fairly flat in the premarket, but structure had remained in tact.

Execution(1 min): nice retest of the 5min ORB. I just missed this. I had this on my list. but missed the entry as it was not on my radar after the open.

What happened(5min): And it continued to trend all day.

Daily Watchlist With Recap

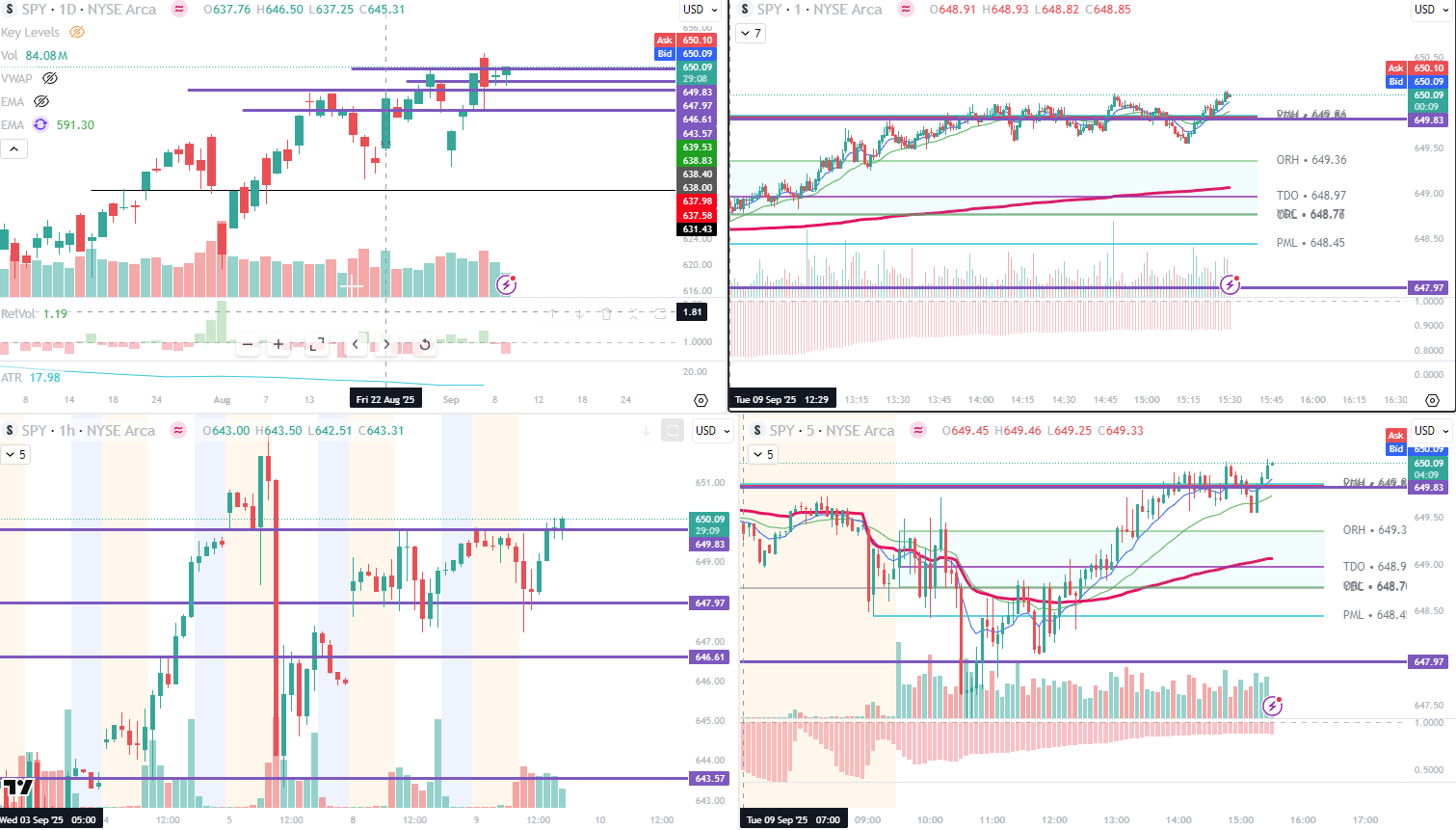

Ticker: SPY

What I am watching: Fairly inside day yesterday. The 650 level has a lot of confluences. Watching this for a move back up to 652 ATH. Also watching what happens if price cant clear the level. Looking for both long and shorts here.

Post Session Chart

We sold off earlier in the session and never tested 650(649.80) Price also did not sell off enough to get involved for shorts.

Ticker: QQQ

What I am watching: The equivalent QQQ level is 580.8s, does not feel as strong as price has not come up against it in the PM

Post Session Chart

Similar structure to SPY, but weaker on the day. Never got to the hTF level.

Ticker: AMD

Above 153.22 price looks good for a move back to the upside.

What I am watching:

Post Session Chart

I had the analysis here, the 153.22 level played extremely well. I need to go back to these higher timeframe levels throughout the day.

Ticker: TSLA

What I am watching: Watching TSLA 350 again. if we can get above I think the move back up the pivot high at 357 and beyond can continue. Look for a retest of the level.

Post Session Chart

The level played to the downside. This is a good example of watching the VWAP once price rejects. Price could not get above that level. Using VWAP as the measure that price is staying heavy.

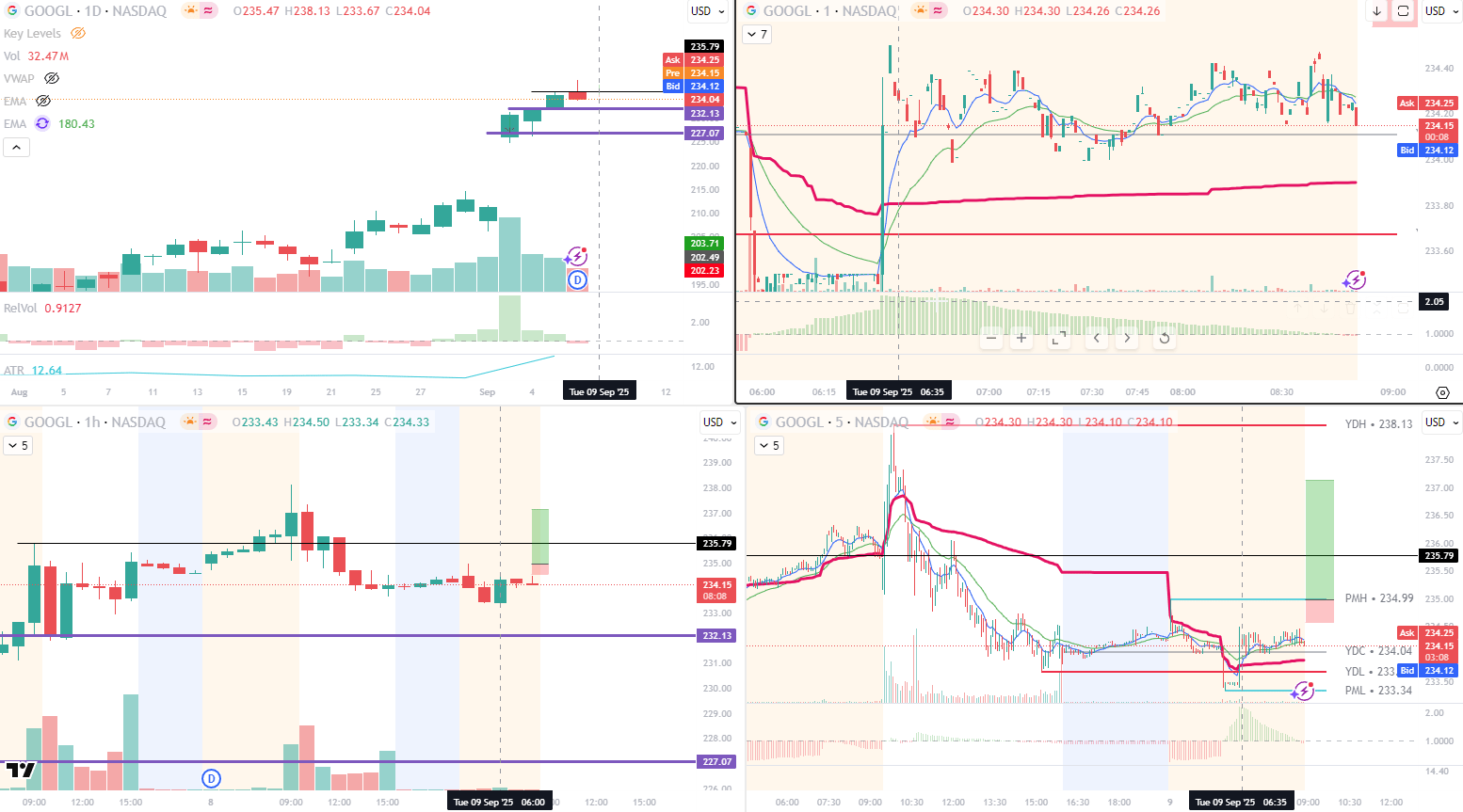

Ticker: GOOG

GOOGL continues to remain strong. Had elevated volume in the early part of the premartek. Like PMH as well as the 235.79 level to trade off.

What I am watching:

Post Session Chart

Another perfect call on the levels, but nothing to show for it.

Ticker: MSFT

Not a name I usually trade, but has been looking weak and seems like price is defending the 498 level now watching to see if we can get above and hold the 500 level. This could setup for a larger move towards the upside. Might be worth playing next weaks contracts.

Post Session Chart

This looked like it was seting up so well in the PM that I focused on it too early. Just bad analysis.

<4 panel image>

Ticker: ORCL

Above 232.50 There is lots of room. This could setup a nice trade back towards the ATH

What I am watching:

Post Session Chart

Nice Rejection off prevoius day low.

Ticker:

<4 panel image>

What I am watching:

Post Session Chart

<4 panel image>

Review

Daily Review

<review of day>