Game Plan

Plan

<review of day>

Review

<review of day>

Trade Reviews

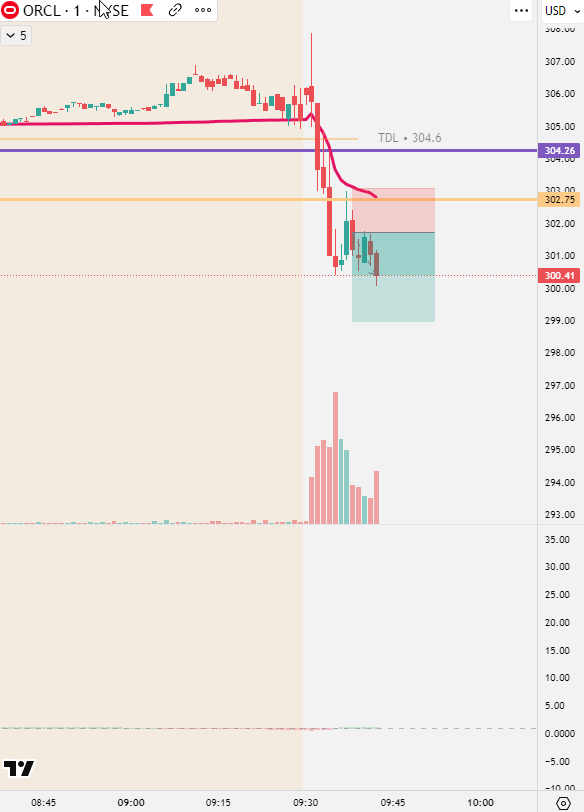

ORCL - Premarket Low Break and Retest into the Gap

Trade Thesis: ORCL has a gap up of almost 30% and it continued to rally into the session on Wednesday, after red day yesterday I was watching the premarket low to see if we can get below and continue to fill the gap.

Context(1day): Massive move on the daily chart after earnings this week.

Context(15min): Premarket structure had failed to gain any momentum to the upside, while the RVOL was up

Execution(1min): After price got below previous day low and premarket low, there was a quick retest that had a hammer candle. Took the move to the downside, targeting 2:1 and beyond.

What happened(5min): Price continued to remain weak throughout the session. I was not able to capture the bulk of the move since the 0day options came back to B/E as it was set to my entry after the first TP hit.

Daily Watchlist With Recap

Ticker: SPY

What I am watching: SPY conitnues to remain bullish. Now above yesterdays close, looking to see if it continues to push into the open. Watching PDC as a support now. Also looking at PDH to see if we can get above and hold for continued push higher.

Post Session Chart

SPY stays inside yesterdays range, going into power hour on a Friday. Not sure it has the strength to push for ATH, but can watch for the 658.33 level on Monday as it as now formed a multiday resistance.

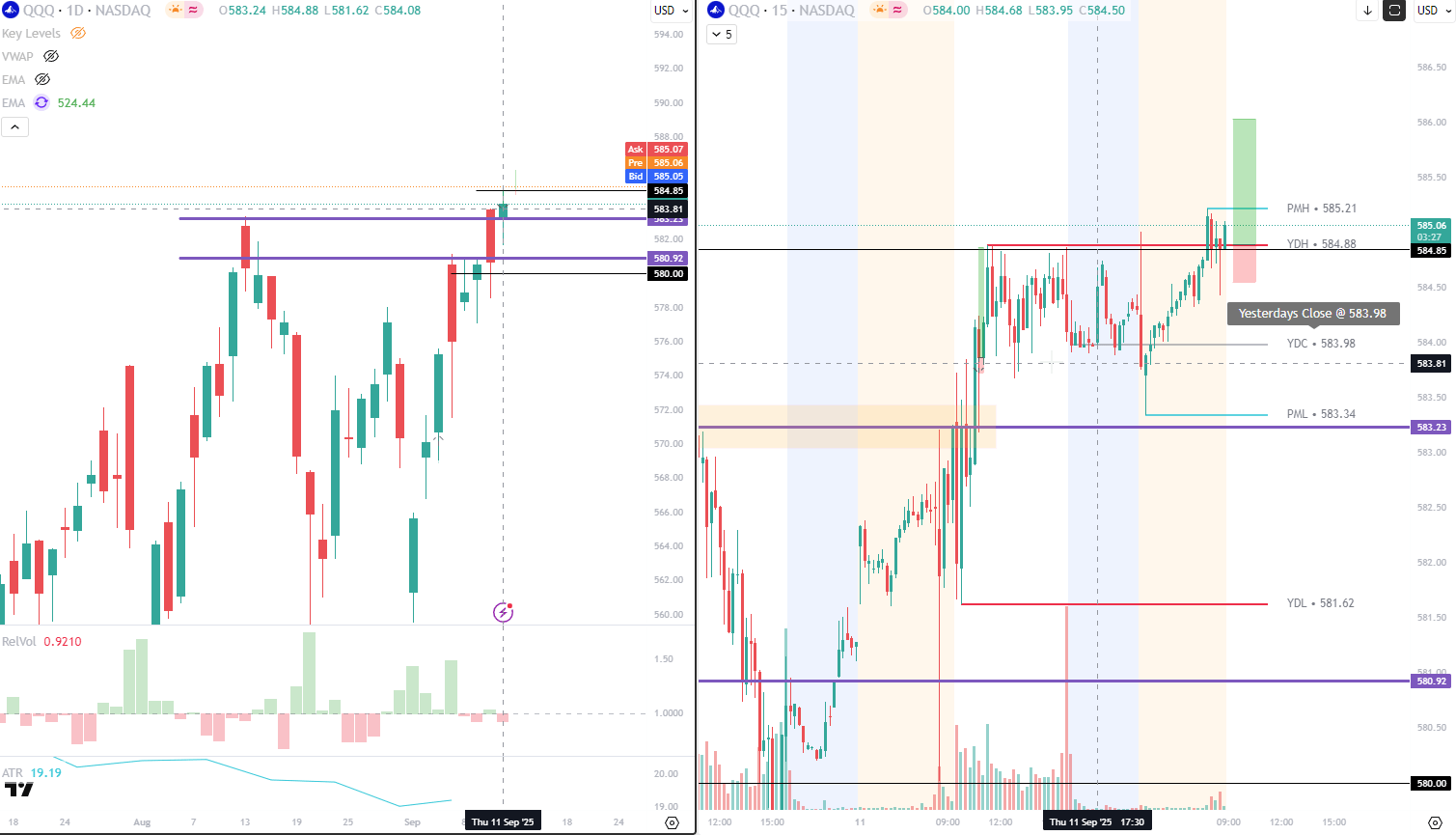

Ticker: QQQ

What I am watching: PDH and premarket high are both in play today. If there is no clear targets on other names would consider taking a trade on QQQ if we can have a nice retest of the PDH level.

Post Session Chart

Q’s a lot more bullish than SPY. Showed strength all day. Lets see if the market can continue to rally next week.

Ticker: TSLA

What I am watching: What a day yesterday. Shot straight up. Still above PDH. Alert level is the PDH 369. As long as we are above it, will be looking for longs. If we sell off into the open watch the premarket low for a defence, and PDH to reclaim.

Post Session Chart

What a beast. This played to play, with a push up both above PMH and the 373.67 level. Unfortunately there was no retest so I had to stay out of it.

Ticker: AMD

What I am watching: If we sell, PML looks like a level we can trade off. Can target down into PDL and beyond.

Post Session Chart

Downside move was what I was watching but the upside is where the money was made today. The alert did trigger but because it had already defended PDL and the price action was choppy I stayed out. Pleased I did so, as this is a trade I probably would have taken in the past.

Ticker: GOOGL

What I am watching: Google continues to trend higher. Alert level is PDH/PMH. Back to an ATH play if we can nicely retest off the zone.

Post Session Chart

Never triggered

Ticker: MSFT

What I am watching: If MSFT can get above 510 there is a lot of room to move. Watching this level today for a swing into next week.

Post Session Chart

This did setup later in the session, but was not all that interested in taking it at this piont.

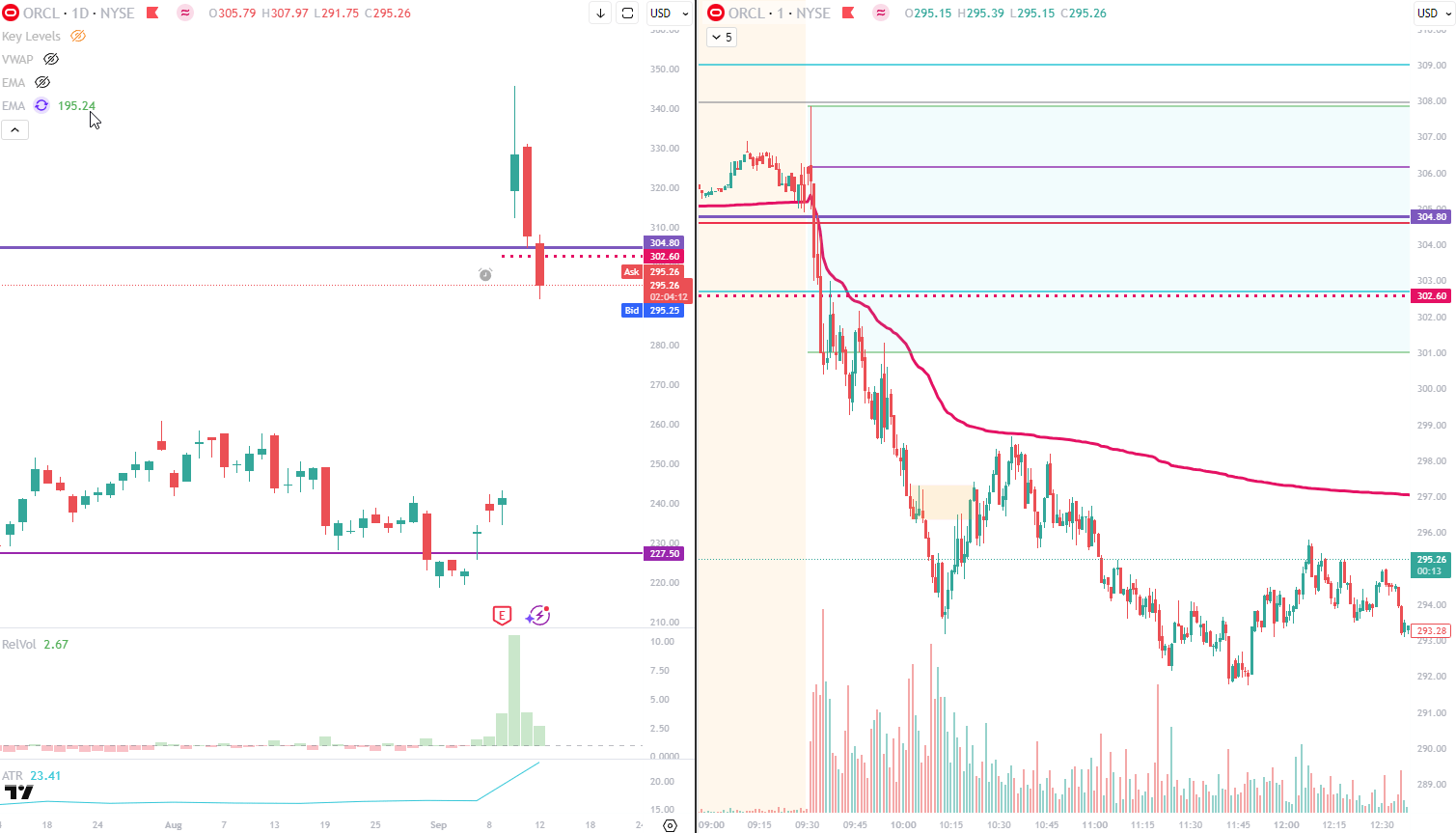

Ticker: ORCL

What I am watching: Dont really want to short such a strong stock, but also hard to ingone this gap. Watching for a downside move as if the market folds over. Alert level is PML

Post Session Chart

Good analysis, took this to the downside. The thesis played out, but was not able to take advantage as I took a 2:1 and got the rest stopped out for B/E

Ticker: OKLO

What I am watching: Had a really nice day yesterday. An ideal trade would be a premarket retest back upto PDH and beyond. Alert level is just above 80

Post Session Chart

This was looking like it was setting up for a PDH retest, but did not see the price action to confirm the trade, rolled over after that.